When it comes to taxes, you can do it yourself. Failure to Complete the “Retirement Pan or Medicare Wage” Blockĭo I need to use a lawyer, accountant, or attorney to help me?.

If you file after the deadline, it may result in late filing penalties. This deadline applies to both e-filing as well as mail submissions. Form W-2, along with Form W-3, should also be filed with Social Security Administration (SSA) by January 31. If you don’t have one or can’t get it from your previous employees, you will need to create a W-2 form by yourself.Īre there any deadlines or times when this form is needed?Īs an employer, you must complete and distribute Form W-2 to employees by January 31. Your employers (current or former) are generally required to send you the W-2 Form for the previous year by the end of the January. It gives the Social Security Administration and the Internal Revenue Service a clear picture of your income tax returns. For example, how much you have added to your retirement plan, your social security and medical earnings, and even any amount you received for your health insurance. The Form also provides the employee with information that is included in his or her income tax form. Why do you need to use the W-2 Form?Īs an employer, you need a W-2 Form to inform the government how much you have paid to and withheld from each employee. It reports the amount a contractor earned in a given tax year. The 1099 MISC form is the equivalent of a W-2 form for independent contractors. That form contains all the information an employer needs to complete IRS 1099 MISC forms. A W-9 form is the form employers have independent contractors fill out at the time of hire. W-2 forms are different from two other tax forms they are sometimes confused with, W- MISC forms. The SSA uses that information to determine future social security, disability, and Medicare benefits. W2 is an IRS form employers that are required to complete and distribute to their employees by January 31 of each calendar year.Įmployers also need to file a copy of the form with the Social Security Administration (SSA) by the end of February.

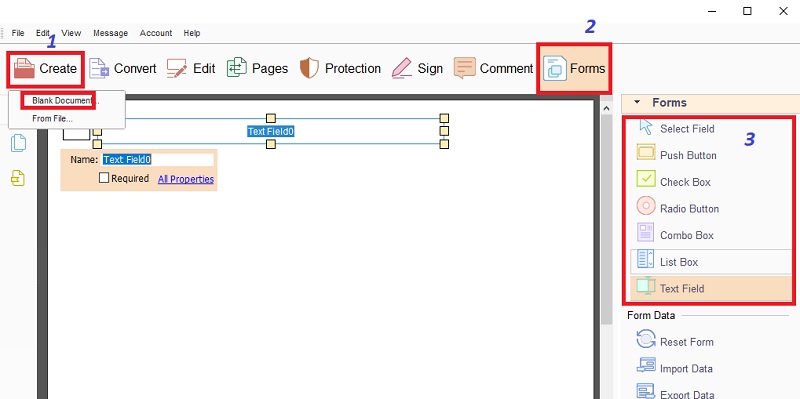

#CREATE PDF FORMS ONLINE GENERATOR#

Our generator tool calculates the state and federal tax withholdings for you automatically. All you need is basic employment and salary information. Our fillable forms make it simple to generate and print out W-2 forms for your employees. There’s no need to get bogged down or discouraged by this paperwork, though.

Take the Guesswork out of W-2 Form CreationĪs a business owner during tax season, in addition to doing your personal and corporate 1040s, you also need to distribute information to your employees via W2 forms – so that they can complete their tax forms. Without it, the IRS will not accept an individual’s income tax return as valid. The W-2 needs to be submitted with an individual’s tax returns. Employers also need to file a copy of the form with the Social Security Administration (SSA) by the end of February. Create Your Version of This Document What is Form W-2?Īlso known as a Wage and Tax Statement, W-2 is the IRS form employers are required to complete and distribute to their employees by January 31 of each calendar year.

0 kommentar(er)

0 kommentar(er)